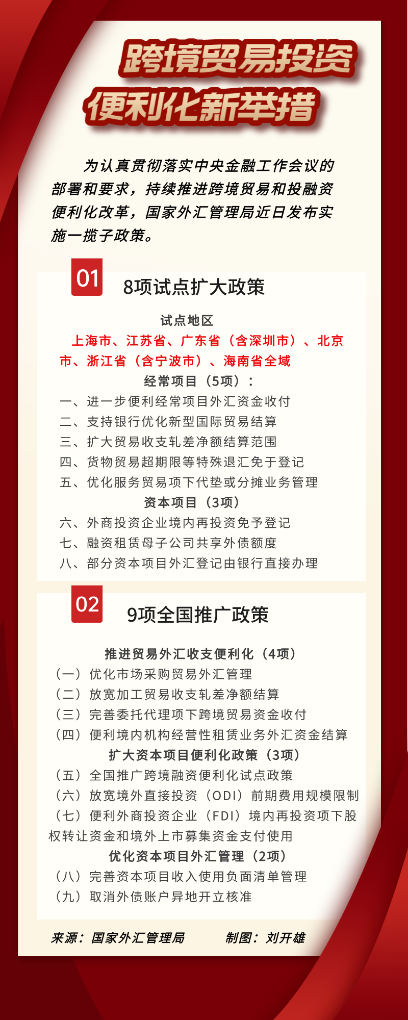

The State Administration of Foreign Exchange (SAFE) has recently issued a series of notices, launching eight pilot expansion policies and nine national promotion policies to further promote cross-border trade and investment facilitation, making it more convenient to "bring in" and "go out".

The Central Financial Work Conference pointed out that the central financial work conference, adhere to the "bring in" and "go out" and give equal importance to steadily expanding the financial sector system-type opening up, enhance the facilitation of cross-border investment and financing, to attract more foreign-funded financial institutions and long-term capital to China to expand their business and develop their business.

"We have formed a package of implementable and promotable policy initiatives based on an in-depth assessment of the previous pilot projects of high-level liberalization of cross-border trade and investment, some of the previous pilot policies, and the results of the research on cross-border local and foreign currency integration management and other policies." The head of the relevant department of the State Foreign Exchange Bureau introduced.

Pilot first if you take a bigger step -

Cross-border trade and investment in a high level of openness pilot, is the National Foreign Exchange Bureau in 2022 launched a high level of openness policy, aimed at promoting the facilitation of cross-border trade and investment.

Relevant departments of the State Foreign Exchange Bureau, the pilot since the effectiveness of good, effective risk prevention and control at the same time, a strong promotion of foreign-related economic development in the pilot region.

The expansion of cross-border trade and investment in a high level of openness pilot, in the scope of the pilot, from the four regions extended to Shanghai, Jiangsu Province, Guangdong Province (including Shenzhen), Beijing, Zhejiang Province (including Ningbo), Hainan Province, the entire region.

Pilot areas of high-quality enterprises and the same foreign counterparties to carry out specific current account foreign exchange business, the pilot areas of prudential compliance banks in the case of ensuring risk control can be for high-quality enterprises for the net settlement of the difference between the rolls; pilot areas of prudential compliance banks can be directly for the pilot of high-quality enterprises for the trade in goods, special refund business, the enterprise does not have to be registered in the foreign exchange bureau beforehand; pilot areas of eligible non-financial enterprises borrowing Foreign debt, listed abroad, can be directly in the bank for the relevant registration procedures ......

The expanded pilot policy measures include five policy measures for current account and three policy measures for capital account. These policy measures are conducive to reducing the transaction costs of enterprises' foreign-related economic activities, improving the efficiency of their capital turnover, and providing more convenient conditions for their cross-border trade and investment and financing activities.

Nationwide promotion of those that are sound and mature -

Of the nine policies promoted nationally, some are national promotions of earlier policy pilots, and some are further extensions of the original policies.

For example, the expansion of the cross-border financing facilitation pilot policy is based on the original cross-border financing facilitation pilot policy for high-tech enterprises and "specialized, special and new" enterprises, and has been extended to the whole country from the 17 provinces (municipalities) where the pilot was conducted before, and has also included science and technology-based small and medium-sized enterprises (SMEs) in the scope of the main body and increased the facilitation amount to the equivalent of the amount of the facilitation amount of the previous 17 provinces (municipalities). The facilitation amount for the previous 17 provinces (municipalities) has been increased to US$10 million equivalent, and the facilitation amount for the rest of the country has been tentatively set at US$5 million equivalent.

This policy initiative can better utilize the two resources of the domestic and overseas markets for the majority of science and technology-based SMEs, expanding more financing channels and financial resources, and also provides a positive solution to solve the financing pain points of science and technology-based enterprises.

In terms of foreign exchange facilitation initiatives to support foreign investment in China, in recent years, the State Administration of Foreign Exchange has continued to simplify business procedures and processes to facilitate foreign-invested enterprises to handle business under capital. This time, in order to further facilitate the foreign exchange income and expenditure of foreign-invested enterprises, the former asset realization account has been adjusted to a capital item settlement account, and the funds in the account can be independently settled and used.

These funds mainly include foreign direct investment and domestic reinvestment, the domestic equity transfer counterparty of overseas direct investment receiving equity transfer consideration funds, and foreign exchange funds raised by domestic enterprises listed overseas. This will greatly enhance the level of facilitation of foreign investment and reinvestment in China, improve the effectiveness of funds for foreign investment in the domestic market, and provide effective support for foreign investors to continue to cultivate the Chinese market and expand their investment in China.

Coordinating financial liberalization and security. "The State Administration of Foreign Exchange has always insisted that reform and opening up and risk prevention and control be piloted and promoted as a whole, supporting the construction of a higher level of a new open economic system and exploring a 'more open and more secure' foreign exchange management model." The above person in charge of the State Foreign Exchange Bureau said.

The person in charge said that the State Bureau of Foreign Exchange will continue to increase the supply of foreign exchange facilitation policies through the expansion of the pilot, national promotion and other measures to support scientific and technological innovation and small and medium-sized micro-enterprises as the focus of optimizing foreign exchange services, and constantly improve the level of facilitation of the main body of the business to comply with the handling of cross-border trade and investment and financing business, effectively stimulate the vitality of the market, and better service to the real economy and the high-quality development of the real economy.